By Order of the Trusts, |

|

Sandra Cavanaugh |

President and Chief Executive Officer |

Russell Investment Company Russell Investment Funds Russell Exchange Traded Funds Trust |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant x Filed by a party other than the registrant ¨

Check the appropriate box:

| Preliminary proxy statement | ||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive proxy statement | ||

| ¨ | Definitive additional materials | |

| ¨ | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 | |

RUSSELL INVESTMENT COMPANY

RUSSELL INVESTMENT FUNDS

RUSSELL EXCHANGE TRADED FUNDS TRUST

(Name of Registrant as Specified in its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

RUSSELL INVESTMENT COMPANY

RUSSELL INVESTMENT FUNDS

RUSSELL EXCHANGE TRADED FUNDS TRUST

1301 Second Avenue, 18th Floor, Seattle, WA 98101

IMPORTANT SHAREHOLDER INFORMATION

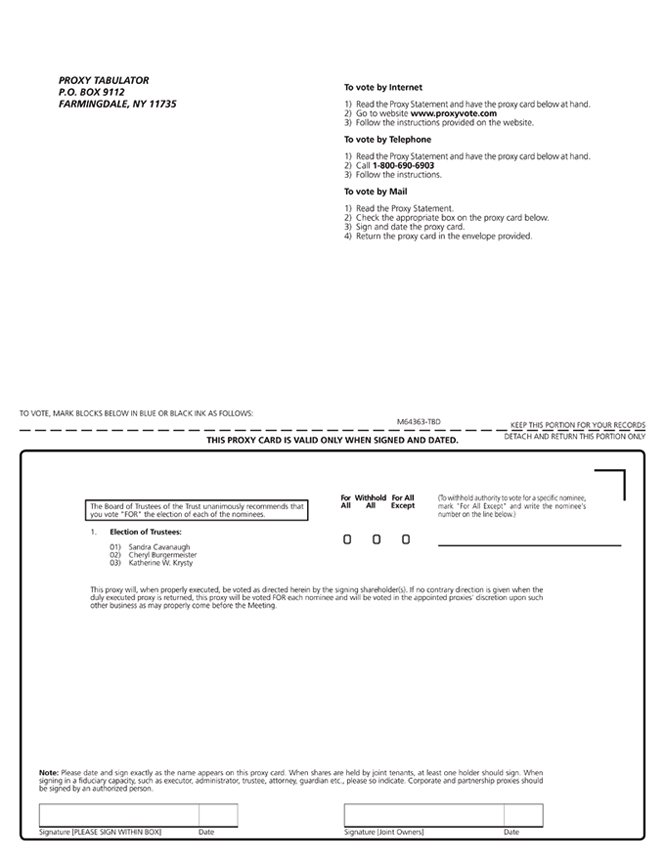

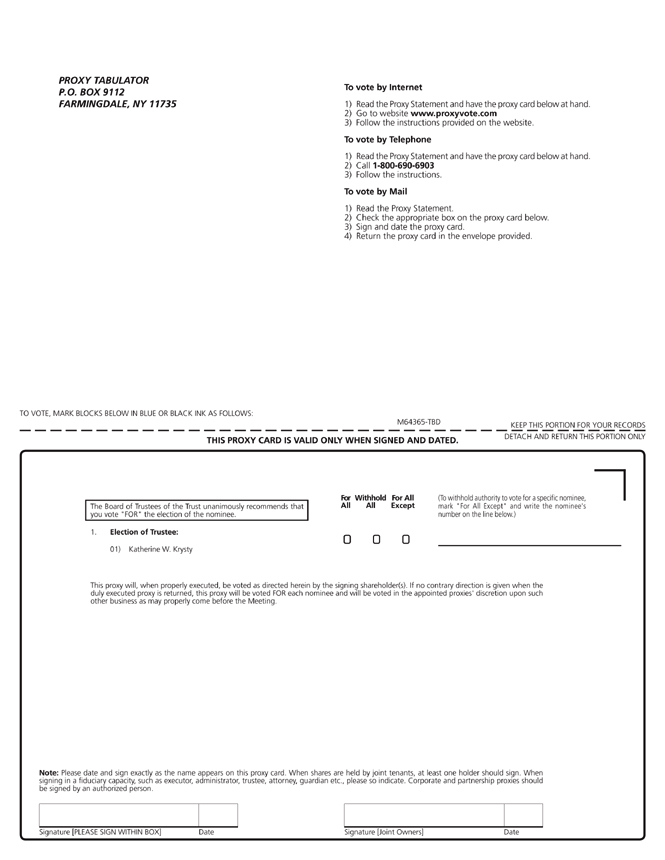

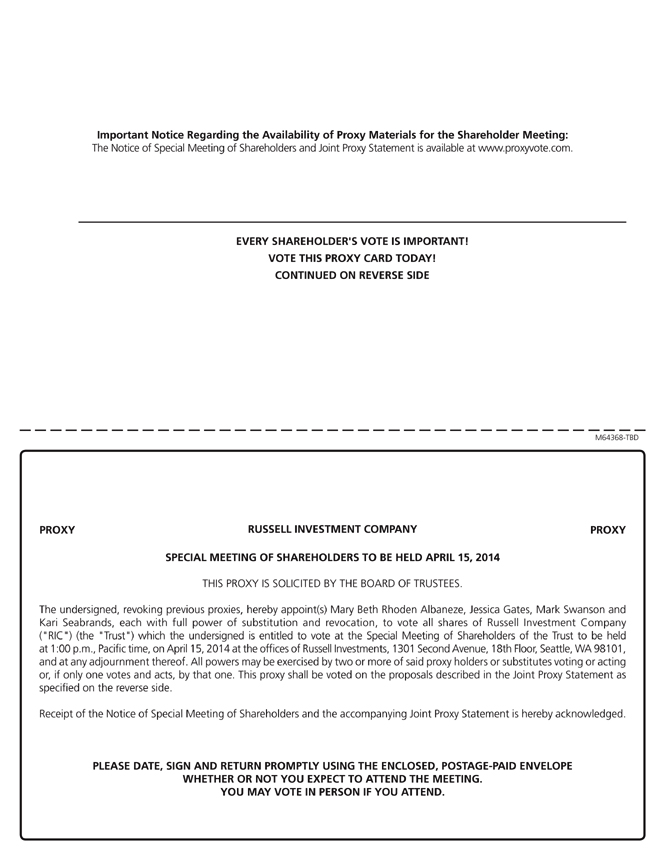

This document contains a Joint Proxy Statement and proxy card(s) for an upcoming shareholder meeting of Russell Investment Company, Russell Investment Funds and Russell Exchange Traded Funds Trust (the “Trusts”). A proxy card is, in essence, a ballot. When you vote using a proxy card, you appoint an individual named on the card to act as your proxy at the actual shareholder meeting and you instruct that individual as to how to vote on your behalf at the shareholder meeting. The proxy card(s) may be completed by checking the appropriate box and voting for or against the proposal.If you simply sign the proxy without specifying a vote, your shares will be voted in accordance with the recommendation of the Board of Trustees.

We are providing proxy material access to shareholders through the Internet. You can access proxy materials and vote at www.proxyvote.com. Details regarding the matters to be acted upon at this special meeting are described in the Notice Regarding the Availability of Proxy Materials you received in the mail.

Please read the Joint Proxy Statement and cast your vote through the Internet or by telephone by following the instructions on your Notice Regarding the Availability of Proxy Materials and at www.proxyvote.com, or if you have requested or received a proxy card by mail, you may vote by signing, voting and returning that proxy card in the envelope provided. Voting your proxy, and doing so promptly, ensures that the Trusts will not need to conduct additional mailings.

Please exercise your right to vote. Thank you.

IMPORTANT NOTICE

Although we recommend that you read the complete Joint Proxy Statement, for your convenience we have provided a brief overview of the proposals. The information provided under the “Questions and Answers” section below is qualified in its entirety by reference to the Joint Proxy Statement.

QUESTIONS AND ANSWERS

Why am I receiving this Joint Proxy Statement?

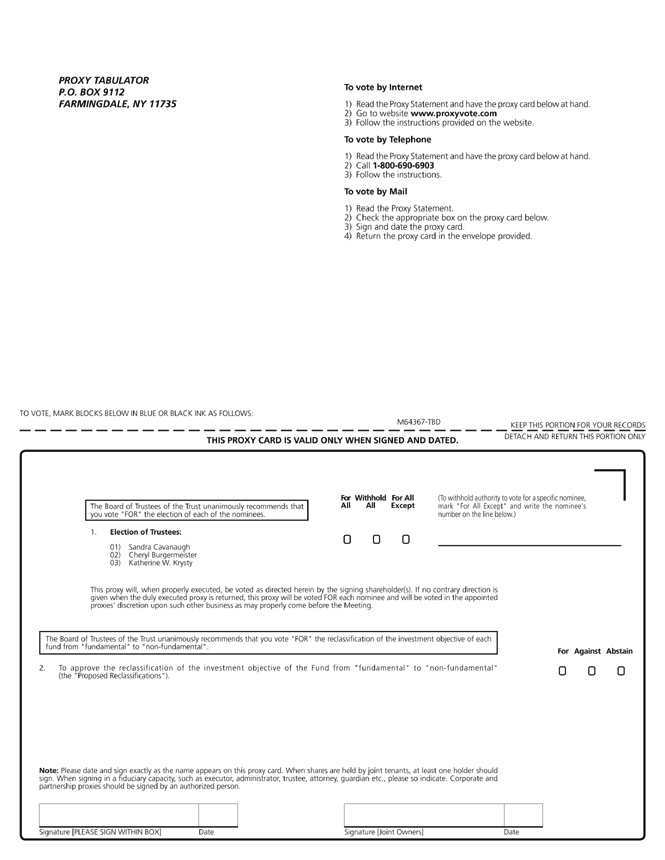

The Board of Trustees is asking you to vote on the following proposals:

PROPOSAL 1: To elect members to the Boards of Trustees (collectively, the “Board”) of Russell Investment Company (“RIC”), Russell Investment Funds (“RIF”) and Russell Exchange Traded Funds Trust (“RET”) (each, a “Trust” and collectively, the “Trusts”).

The Trusts are currently served by a single set of trustees (the “Trustees”), whereby all trustees serve on the Board of each Trust. The Trusts are sponsored by Russell Investment Management Company (“RIMCo” or the “Manager”), who serves as the investment adviser of each of the separate series of the Trusts (each, a “Fund” and collectively, the “Funds”).

At their meeting held on December 4, 2013, the Trustees determined to present the election of the Trustees who have not been previously elected by the Shareholders (collectively, the “Trustee Nominees”) to hold office until such Trustee Nominee sooner dies, retires, resigns or is removed, as provided for in the Trusts’ organizational documents. Each of RIC, RIF and RET currently have eight Trustees, five of whom have previously been elected by RIC and RIF Shareholders and seven of whom have previously been elected by RET Shareholders. Proposal 1 will not affect the status of those Trustees previously elected by RIC, RIF and RET Shareholders. If any Trustee Nominee does not receive a plurality of all outstanding shares of the Trust voting, such Trustee Nominee will remain on the Board of such Trust as a non-shareholder elected Trustee. RIC and RIF also have one Trustee Emeritus. The Trustee Emeritus does not have the power to vote on matters coming before the Board, or to direct the vote of any Trustee, and generally is not responsible or accountable in any way for the performance of the Board’s responsibilities.

For purposes of Proposal 1, you are entitled to vote if you own shares in any one or more Funds as of the close of the Record Date (defined below) and your vote will be counted together with the votes of Shareholders of other Funds in the same Trust.

PROPOSAL 2: To approve the reclassification of the investment objective of the following RIC Funds from “fundamental” to “non-fundamental” (the “Proposed Reclassifications”): the Russell U.S. Defensive Equity Fund, Russell Investment Grade Bond Fund and Russell International Developed Markets Fund (for purposes of Proposal 2, each, a “Proposal 2 Fund”).

For purposes of the Proposed Reclassifications in Proposal 2, you are entitled to vote if you own shares in any one or more Proposal 2 Funds as of the close of the Record Date (defined below) and your vote with respect to one Proposal 2 Fund in which you hold shares will be counted together with the votes of other Shareholders of such Proposal 2 Fund. A vote for a Proposed Reclassification with respect to one Proposal 2 Fund will not affect the approval of the Proposed Reclassification with respect to any other Proposal 2 Fund.

Why am I being asked to adopt the Proposed Reclassifications?

The Proposed Reclassifications will provide RIMCo with additional flexibility to conduct the investment program of each Proposal 2 Fund. However, if the Proposed Reclassifications are approved by Shareholders of the Proposal 2 Funds, a change to the investment objective of a Proposal 2 Fund would still need to be approved

by the Board, which, through its Investment Committee, reviews and monitors the investment strategies and investment performance of the Funds, including the Proposal 2 Funds. Subsequent to the Proposed Reclassification, RIMCo would then be able to respond to changing market conditions and circumstances consistent with applicable laws, without the potential for the expense and delay that may be associated with arranging for a Shareholder meeting to approve changes in a Proposal 2 Fund’s investment objective.

How do the Trustees suggest that I vote?

After careful consideration, the Trustees, including the Independent Trustees of the Board, unanimously recommend that you vote “FOR” each proposal listed on the proxy card.

Why do the Trustees recommend that I vote “FOR” each of the proposals?

PROPOSAL 1:The Trustees believe that each Trustee Nominee’s experience, qualifications, attributes and skills on an individual basis and in combination with those of the other Trustee Nominees and the Board, collectively, lead to the conclusion that the Trustee Nominees possess the requisite experience, qualifications, attributes and skills to serve on the Board. The Trustees believe that the Trustee Nominees’ ability to review critically, evaluate, question and discuss information provided to them; to interact effectively with RIMCo, other service providers, legal counsel and independent public accountants; and to exercise effective business judgment in the performance of their duties as Trustees, support this conclusion. The Trustees have also considered the contributions that each Trustee Nominee can make to the Board and each Trust. Additionally, in considering the Trustee Nominees, the Trustees took into account the concern for the continued efficient conduct of the Trusts’ business. In particular, the Trustees considered the requirements of the Investment Company Act of 1940, and any amendments thereto, as they apply to the election of Trustees generally and the Trustee Nominees in particular.

PROPOSAL 2:The Trustees recommend that Shareholders vote to reclassify the Proposal 2 Funds’ respective investment objectives from “fundamental” to “non-fundamental” in order to provide RIMCo with additional flexibility to conduct the investment program of each Proposal 2 Fund. However, if the Proposed Reclassifications are approved by Shareholders of the Proposal 2 Funds, a change to the investment objective of a Proposal 2 Fund would still need to be approved by the Board, which, through its Investment Committee, reviews and monitors the investment strategies and investment performance of the Funds, including the Proposal 2 Funds. Subsequent to the Proposed Reclassification, RIMCo would then be able to respond to changing market conditions and circumstances consistent with applicable laws, without the potential for the expense and delay that may be associated with arranging for a Shareholder meeting to approve changes in a Proposal 2 Fund’s investment objective. The Joint Proxy Statement explains that Shareholders are only being asked to approve the reclassification of the Proposal 2 Funds’ respective investment objectives from “fundamental” to “non-fundamental” and are not being asked to approve changes to any Proposal 2 Fund’s investment objective.

Although the Proposed Reclassifications will provide RIMCo with greater flexibility to respond to future investment opportunities, RIMCo does not anticipate that the proposed changes will materially affect the manner in which the Proposal 2 Funds are currently managed. Accordingly, RIMCo has represented to the Board that it does not anticipate that the Proposed Reclassifications will result in a material change in the level of investment risk associated with investment in any Proposal 2 Fund. In the future, if the Board determines to change materially the manner in which any Proposal 2 Fund is managed, that Fund’s prospectus will be amended to reflect such change and the Fund would provide Shareholders with reasonable notice before the effective date of such change.

Will my vote make a difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Joint Proxy Statement and cast your vote through the Internet or by telephone by following the instructions on your Notice Regarding the Availability of Proxy Materials and at www.proxyvote.com. If you have requested or received a proxy card by mail, you may vote by signing, voting and returning that proxy card in the envelope provided. We encourage all shareholders to participate in the governance of the Trusts.

Whom do I call if I have questions?

We will be happy to answer your questions about this proxy solicitation. If you have questions, please call Broadridge Financial Solutions, Inc. at 1-855-976-3325.

How can I vote my shares?

Please refer to the instructions on how to vote found in your Notice Regarding the Availability of Proxy Materials and at www.proxyvote.com. Shareholders are encouraged to vote their shares through the Internet or by the telephone. Shareholders may also vote their shares by requesting a proxy card by mail and signing, voting and returning that proxy card in the envelope provided.

RUSSELL INVESTMENT COMPANY

RUSSELL INVESTMENT FUNDS

RUSSELL EXCHANGE TRADED FUNDS TRUST

1301 Second Avenue, 18th Floor, Seattle, WA 98101

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To all shareholders of Russell Investment Company, Russell Investment Funds and Russell Exchange Traded Funds Trust:

Russell Investment Company (“RIC”), Russell Investment Funds (“RIF”) and Russell Exchange Traded Funds Trust (“RET”) (each, a “Trust” and collectively, the “Trusts”) are holding a special meeting (the “Special Meeting”) of all shareholders of each of the separate series of the Trusts (each, a “Fund” and collectively, the “Funds”) on April 15,14, 2014. The Special Meeting will be held at the offices of Russell Investments, 1301 Second Avenue, 18th Floor, Seattle, WA 98101, at 10:00 a.m. Pacific Time.

RIC and RIF are each Massachusetts business trusts, each operating as a registered management investment company. RIC and RIF currently offer shares of 37 and 9 Funds, respectively. RET is a Delaware statutory trust, operating as a registered management investment company. RET currently offers shares of one (1) Fund, the Russell Equity ETF. Proposal 1 relates to all shareholders of the RIC, RIF and RET Funds. Proposal 2 relates only to shareholders of the following RIC Funds: Russell U.S. Defensive Equity, Russell Investment Grade Bond and Russell International Developed Markets Funds (for purposes of Proposal 2, each a “Proposal 2 Fund”).

The Special Meeting is being held for the purpose of (i) electing three (3) persons (each, a “Trustee Nominee”) to the Board of Trustees of each of RIC and RIF and one (1) person to the Board of Trustees of RET and (ii) reclassifying the investment objective of certain RIC Funds, the Proposal 2 Funds, from “fundamental” to “non-fundamental.” These matters are discussed in detail in the proxy statement enclosed with this notice.

The Trusts have fixed the close of business on February 5, 2014 as the record date for determining shareholders entitled to notice of and to vote at the Special Meeting. Each share of each Fund is entitled to one vote on each proposal applicable to such Fund and a proportionate fractional vote for each fractional share held. You are cordially invited to attend the Special Meeting.

Regardless of whether you plan to attend the Special Meeting, we urge you to vote through the Internet at www.proxyvote.com or by telephone by following the instructions on the Notice Regarding the Availability of Proxy Materials you received in the mail and which instructions are also provided on that website, or, if you have requested or received a proxy card by mail, by signing, voting and returning your proxy card in the postage paid envelope so that a quorum will be present and a maximum number of shares may be voted. For specific instructions on how to vote your shares, please review the instructions for each of these voting options as detailed in your Notice Regarding the Availability of Proxy Materials and in the Joint Proxy Statement. If you attend the Special Meeting, you may vote in person even if you have previously returned your proxy card or have voted through the Internet or by telephone. Proxies may be revoked at any time before they are exercised by submitting a revised proxy, by giving written notice of revocation to the Trusts or by voting in person at the Special Meeting. It is very important that you vote your proxy promptly so that a quorum may be ensured and the costs of further solicitations avoided.

As always, we thank you for the trust you have placed in our firm.

By Order of the Trusts, |

|

Sandra Cavanaugh |

President and Chief Executive Officer |

Russell Investment Company Russell Investment Funds Russell Exchange Traded Funds Trust |

[February[], 5, 2014]

[February[], 5, 2014]

RUSSELL INVESTMENT COMPANY

RUSSELL INVESTMENT FUNDS

RUSSELL EXCHANGE TRADED FUNDS TRUST

1301 Second Avenue, 18th Floor, Seattle, WA 98101

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 15,14, 2014

The Funds’ Notice of a Special Meeting of Shareholders, Joint Proxy Statement and Form of Proxy Card are available on the Internet at www.proxyvote.com.

PLEASE RESPOND. YOUR VOTE IS IMPORTANT WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING. TO ASSURE THE PRESENCE OF A QUORUM AT THE SPECIAL MEETING, AND TO AVOID THE ADDED COST OF FOLLOW-UP SOLICITATIONS AND POSSIBLE ADJOURNMENTS, PLEASE TAKE A FEW MINUTES TO READ THE JOINT PROXY STATEMENT AND CAST YOUR VOTE THROUGH THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS AND ON WWW.PROXYVOTE.COM, OR IF YOU HAVE REQUESTED OR RECEIVED A PROXY CARD BY MAIL, YOU MAY VOTE BY SIGNING, VOTING AND RETURNING THAT PROXY CARD IN THE ENVELOPE PROVIDED. PLEASE TAKE ADVANTAGE OF THESE PROMPT AND EFFICIENT VOTING OPTIONS. YOU MAY ALSO VOTE BY CALLING THE BROADRIDGE FINANCIAL SOLUTIONS, INC. REPRESENTATIVE AT 1-855-976-3325.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card. |

| 3. | Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| Corporate Accounts | Valid Signature | |

ABC Corp. | ABC Corp. (by John Doe, Treasurer) | |

ABC Corp. | John Doe, Treasurer | |

ABC Corp. c/o John Doe, Treasurer. | John Doe | |

ABC Corp. Profit Sharing Plan. | John Doe, Trustee | |

| Trust Accounts | ||

ABC Trust | Jane B. Doe, Trustee | |

Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe | |

| Custodial or Estate Accounts | ||

John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith | |

John B. Smith | John B. Smith, Jr., Executor | |

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY, NO MATTER HOW MANY SHARES YOU OWN.

RUSSELL INVESTMENT COMPANY

RUSSELL INVESTMENT FUNDS

RUSSELL EXCHANGE TRADED FUNDS TRUST

1301 Second Avenue, 18th Floor, Seattle, WA 98101

JOINT PROXY STATEMENT Dated [February [ ], 2014]February 5, 2014

SPECIAL MEETING OF SHAREHOLDERS

To be Held on April 15,14, 2014

Introduction

Russell Investment Company (“RIC”), Russell Investment Funds (“RIF”) and Russell Exchange Traded Funds Trust (“RET”) (each, a “Trust” and collectively, the “Trusts”) have called a special meeting (the “Special Meeting”) of all shareholders of each of the separate series of the Trusts (each, a “Fund” and collectively, the “Funds”) in order to seek shareholder approval of proposals relating to (i) the election of members to the Trusts’ Boards of Trustees (collectively, the “Board”) and (ii) the reclassification of the investment objective of the following RIC Funds from “fundamental” to “non-fundamental”: the Russell U.S. Defensive Equity Fund, Russell Investment Grade Bond Fund and Russell International Developed Markets Fund (for purposes of Proposal 2, each a “Proposal 2 Fund”). The Special Meeting will be held at the offices of Russell Investments, 1301 Second Avenue, 18th Floor, Seattle, WA 98101, on April 15,14, 2014 at 10:00 a.m. Pacific Time. The Board has sent a Notice Regarding the Availability of Proxy Materials to you and all other shareholders of record who have a beneficial interest in the Funds as of the close of business on or about February 5, 2014. If you expect to attend the Special Meeting in person, please call the Trusts at 1-800-787-7354 (RIC and RIF Shareholders) or1-888-775-3837 (RET Shareholders) to inform them of your intentions.

Items For Consideration

The Board is asking you to approve proposals relating to (i) the election of three (3) persons (each, a “Trustee Nominee”) to the Board of each of RIC and RIF and one (1) person to the Board of RET and (ii) the reclassification of the investment objective of certain RIC Funds, the Proposal 2 Funds, from “fundamental” to “non-fundamental.”

Who May Vote

All shareholders of the Funds who own shares as of the close of business on February 5, 2014 (the “Record Date”) are entitled to vote on the proposal(s) applicable to their Fund shares. Each share of each Fund will be entitled to one vote on each proposal applicable to such Fund at the Special Meeting and each fraction of a share will be entitled to the fraction of a vote equal to the proportion of a full share represented by the fractional share. The following tableAppendix A sets forth the number of shares of beneficial interest outstanding and entitled to be voted of each class of each Fund as of [ ],January 17, 2014. [TO BE COMPLETED UPON AMENDMENT]

| ||||

| ||||

Voting by Proxy

Shareholders may vote through the Internet voting, through telephone touch-tone voting, by signing and returning a proxy card, or by attending the Special Meeting in person and voting. To vote by telephone or

Internet, follow the voting instructions as outlined on the Notice Regarding the Availability of Proxy Materials, which waswill be mailed to

shareholders on or about [ ],February 19, 2014. These options require shareholders to input a control number, which is located on your Notice Regarding the Availability of Proxy Materials. After entering this number, shareholders will be prompted to provide their voting instructions on the Proposals. Shareholders will have the opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Shareholders who vote on the Internet, in addition to confirming their voting instructions prior to submission, may also request an e-mail confirming their instructions. If you have requested or received a proxy card by mail, you may use the enclosed postage-paid envelope to mail your proxy card.

If you need more information on how to vote, or if you have any questions, please call the Funds’ proxy solicitation agent, Broadridge Financial Solutions, Inc., at 1-855-976-3325. The Trusts urge you to fill out and return your proxy card or vote by telephone or the Internet, even if you plan to attend the Special Meeting. Doing so will not affect your right to attend the Special Meeting and vote.

The Trusts have named Mary Beth Rhoden Albaneze, Jessica Gates, Mark Swanson and Kari Seabrands as proxies, and their names appear on your proxy card(s). By signing your proxy card and returning it or, alternatively, by voting through the Internet or by the telephone by following the instructions on the Notice Regarding the Availability of Proxy Materials, you are appointing those persons to vote for you at the Special Meeting. If you properly fill in your proxy card and return it to the Trusts in time to vote, one of the appointed proxies will vote your shares as you have directed. If you sign and return your proxy card, but do not make specific choices, one of the appointed proxies will vote your shares on the proposal(s) as recommended by the Board.

If an additional matter is presented for vote at the Special Meeting, one of the appointed proxies will vote in accordance with his/her best judgment. At the time this Joint Proxy Statement was printed, the Trusts were not aware of any other matter that needed to be acted upon at the Special Meeting other than the proposals discussed in this Joint Proxy Statement.

If you appoint a proxy by signing and returning your proxy card, you can revoke that appointment at any time before it is exercised. You can revoke your proxy by sending in another proxy with a later date, by notifying the Trusts in writing that you have revoked your proxy prior to the Special Meeting, by writing to the Secretary of the Funds at the following address: 1301 Second Avenue, 18th Floor, Seattle, WA 98101, or by attending the Special Meeting and voting in person. Proxies voted by telephone or through the Internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

Voting in Person

If you attend the meeting and wish to vote in person, you will be given a ballot when you arrive. If you have already voted by proxy and wish to vote in person instead, you will be given an opportunity to do so during the Special Meeting. If you attend the Special Meeting, but your shares are held in the name of your broker, bank or other nominee, you must bring with you a letter from that nominee stating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote.

Recommendation

The proxy is solicited by the Board on behalf of the Trusts, all of whom recommend a vote “FOR ALL” the Trustee Nominees for RIC and RIF and “FOR” the Trustee Nominee for RET, as described in this Joint Proxy Statement, and “For” Proposal 2.

Requirement of a Quorum and Vote Needed

A quorum is the number of outstanding shares, as of the Record Date, that must be present, in person or by proxy, in order for a Trust to hold a valid shareholder meeting. The Trusts cannot hold a valid shareholder

meeting unless there is a quorum of shareholders present in person or by proxy. With respect to RIC and RIF, RIC’s Second Amended and Restated Master Trust Agreement, as amended, and RIF’s Amended and Restated Master Trust Agreement, as amended, each require that the presence, in person or by proxy, of a majority of the shares entitled to vote shall constitute a quorum, unless a larger number of shares is required pursuant to law. With respect to RET,

RET’s Amended and Restated Agreement and Declaration of Trust requires that the presence, in person or by proxy, of more than twenty-five percent (25%) of the total combined net asset value of all shares issued and outstanding and entitled to vote shall constitute a quorum, unless a larger number of shares is required pursuant to law. With respect to the proposal(s) affecting RIC and RIF, a majority of the shares entitled to vote on each such proposal as of the Record Date is required for a quorum for this Special Meeting. With respect to the proposal affecting RET, more than twenty-five percent (25%) of the total combined net asset value of all shares of RET entitled to vote as of the Record Date is required for a quorum.

With respect to Proposal 1, all Shareholders of the Funds as of the Record Date will be entitled to vote on Proposal 1. For purposes of Proposal 1, your vote will be counted together with the votes of Shareholders of other Funds in the same Trust.

With respect to Proposal 2, only Shareholders of the Proposal 2 Funds as of the Record Date will be entitled to vote on Proposal 2. For purposes of the Proposed Reclassifications in Proposal 2, your vote with respect to one Proposal 2 Fund in which you hold shares will be counted together with the votes of other Shareholders of such Proposal 2 Fund. A vote for a Proposed Reclassification with respect to one Proposal 2 Fund will not affect the approval of the Proposed Reclassification with respect to any other Proposal 2 Fund.

With respect to Proposal 1, each Trustee Nominee must receive a plurality of all outstanding shares of the Trust voting, and the Trustee Nominees receiving the most “FOR” votes will be elected (even if less than a majority of the votes cast), provided a quorum is present. Accordingly, with respect to RIC and RIF, each of Mses. Cavanaugh, Burgermeister and Krysty must be one of the three Trustee Nominees receiving the most “FOR” votes in order to be elected. With respect to RET, Ms. Krysty must be the Trustee Nominee receiving the most “FOR” votes in order to be elected. Because each Trustee Nominee is up for election for a distinct seat on the Board and because it is expected that each such election will be uncontested, to the extent that a Trustee Nominee receives any votes, such Trustee Nominee will be elected.

With respect to Proposal 2, the approval of the reclassification of the investment objective of each Proposal 2 Fund from “fundamental” to “non-fundamental” requires the approval of a majority of the outstanding voting securities of that Proposal 2 Fund. The vote of a majority of the outstanding voting securities of a Proposal 2 Fund means the vote of the lesser of (a) 67% or more of the voting securities of such Proposal 2 Fund present at the meeting, if the holders of more than 50% of the outstanding voting securities of the Proposal 2 Fund are present or represented by proxy; or (b) more than 50% of the outstanding voting securities of the Proposal 2 Fund. Shareholders of each Proposal 2 Fund will vote separately on Proposal 2. The investment objective applicable to each Proposal 2 Fund will be reclassified only if approved by the Shareholders of that Proposal 2 Fund.

Under rules applicable to broker-dealers, if your broker holds your shares in its name, the broker is allowed to vote your shares on the election of Trustees even if it has not received voting instructions from you. Broker non-votes (i.e., the scenario where a broker-dealer holding shares of a fund on behalf of a beneficial owner does not receive voting instructions from such beneficial owner, and the broker-dealer subsequently declines to vote, or is not permitted to vote, those shares at the special meeting) and abstentions with respect to Proposal 1 count as “present” solely for purposes of establishing a quorum, but will not count as votes against each nominee. Broker non-votes and abstentions will have the effect of a vote against Proposal 2.

Adjournments

In the event that a quorum is not present at the Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies. In addition, an adjournment is permitted if a quorum is present, but a majority has not been reached with respect to Proposal 2.

Any such adjournment will require the affirmative vote of a majority of those shares represented at the Special Meeting in person or by proxy and entitled to vote at the Special Meeting. Signed proxies that have been returned to the Trusts without any indication of how the shareholder wished to vote will be voted in favor of the proposal to adjourn the Special Meeting.

Costs of the Special Meeting

The Funds will bear all expenses incurred in connection with Proposal 1 and Proposal 2, including the cost of soliciting proxies and the cost associated with any adjournments, whether or not the proposals are approved by shareholders. The cost of the Special Meeting will be allocated to each Trust, and borne by the Funds organized under such Trust. Costs that are collectively borne by the Funds of each Trust will be allocated among the Funds of such Trust on the basis of relative net assets, except when direct costs can reasonably be attributed to one or more specific Funds.

Additional Information

The date of this Joint Proxy Statement is[February[ ], 2014]. 5, 2014.

Additional information about the Funds is available in their respective prospectuses, statements of additional information and annual and semi-annual reports to Shareholders. The Funds’ most recent annual and semi-annual reports have previously been mailed to Shareholders. Additional copies of any of these documents are available without charge by calling 1-800-787-7354 (RIC and RIF Shareholders) or1-888-775-3837 (RET Shareholders), by writing to 1301 Second Avenue, 18th Floor, Seattle, WA 98101 or by visiting the Funds’ website at www.russell.com. All of these documents also are on file with the Securities and Exchange Commission (the “SEC”) and are available on the SEC’s website at www.sec.gov.

Are the Trustees and Officers of the Trusts Paid for Their Services to the Trusts? | ||||

What are the Effects of Reclassifying Each Investment Objective? | ||||

| Exhibit A – Audit Committee Charter | ||||

Exhibit B – Audit and Non-Audit Services Pre-Approval Policy | ||||

| Appendix A – Fund Shares Outstanding as of January 17, 2014 | ||||

PROPOSAL 1: ELECTION OF TRUSTEES TO THE BOARD

Ms. Sandra Cavanaugh, Ms. Cheryl Burgermeister and Ms. Katherine Krysty are the Trustee Nominees. Each currently serves on the Board of each Trust, and each was elected as a Trustee by the Board until the Trustee Nominee sooner dies, retires, resigns or is removed, as provided for in the Trusts’ organizational documents pursuant to Article III, Section 3.1(c) of RIC’s Second Amended and Restated Master Trust Agreement, as amended, Article III, Section 3.1(c) of RIF’s Amended and Restated Master Trust Agreement, as amended, and Article IV, Section 1 of RET’s Amended and Restated Agreement and Declaration of Trust. Ms. Sandra Cavanaugh and Ms. Cheryl Burgermeister were also elected by shareholders of RET to serve on the RET Board at a shareholder meeting on October 26, 2012. It is now proposed that Ms. Cheryl Burgermeister and Ms. Sandra Cavanaugh, with respect to RIC and RIF, and Ms. Katherine Krysty, with respect to RIC, RIF and RET, be elected by shareholders to serve on the Board of the Trusts.

One of the Trustee Nominees, Ms. Sandra Cavanaugh, serves as the Trusts’ President and is considered to be an interested person of the Trusts, as that term is defined by the Investment Company Act of 1940, as amended (the “1940 Act”). No Trustee Nominee is a party adverse to the Trusts or any of their affiliates in any material legal proceeding, nor does any Trustee Nominee have a materially adverse interest to the Trusts. The tables below set forth information concerning each Trustee Nominee.

Name: | Sandra Cavanaugh* | |

Date of Birth: | May 10, 1954 | |

Address: | 1301 Second Avenue, 18th Floor, Seattle, WA 98101 | |

Position(s) Held with the Trust: | President and Chief Executive Officer, Trustee | |

Term of Office: | President and Chief Executive Officer of the Trusts until successor is chosen and qualified by Trustees; Trustee of the Trusts appointed until successor is duly elected and qualified | |

Length of Time Served: | Trustee of RIC and RIF Since 2010; Trustee of RET since 2012 President and Chief Executive Officer of RIC and RIF since 2010 President and Chief Executive Officer of RET since 2012 | |

Number of Funds in the Fund Complex Overseen: | 47 | |

Principal Occupation(s) During the Past Five Years: | President and CEO RIC, RIF and RET; Chairman of the Board,Co-President and CEO, Russell Financial Services, Inc. (“RFS”); Chairman of the Board, President and CEO, Russell Fund Services Company (“RFSC”); Director, RIMCo; Chairman of the Board, President and CEO, Russell Insurance Agency, Inc. (“RIA”) (insurance agency); May 2009 to December 2009, Executive Vice President, Retail Channel, SunTrust Bank; 2007 to January 2009, Senior Vice President, National Sales – Retail Distribution, JPMorgan Chase/Washington Mutual, Inc. (investment company) | |

Other Directorships Held During the | None |

* | Ms. Cavanaugh is an “interested” Trustee, as that term is defined in the 1940 Act, because of her positions as President and Chief Executive Officer of the Trusts and as an officer and/or director of one or more affiliates of the Trusts. | ||

The following trustee nominees are considered to be “disinterested” or “independent” persons of the Trusts, meaning that they have no direct affiliation with the Trusts, RIMCo, any sub-advisers, or any other service providers to the Trusts.

Name: | Cheryl Burgermeister | |

Date of Birth: | June 26, 1951 | |

Address: | 1301 Second Avenue, 18th Floor, Seattle, WA 98101 | |

Position(s) Held with the Trust: | Trustee | |

Term of Office: | Until successor is duly elected and qualified | |

Length of Time Served: | Trustee of RIC, RIF and RET Since 2012 | |

Number of Funds in the Fund Complex Overseen: | 47 | |

Principal Occupation(s) During the Past Five Years: | Retired Trustee and Chairperson of Audit Committee, Select Sector SPDR Funds (investment company) Trustee and Finance Committee Member/Chairman, Portland Community College (charitable organization) | |

Other Directorships Held During the Past Five Years: | Trustee and Chairperson of Audit Committee, Select Sector SPDR Funds (investment company) Trustee, ALPS Series Trust (investment company) |

Name: | Katherine W. Krysty | |

Date of Birth: | December 3, 1951 | |

Address: | 1301 Second Avenue, 18th Floor, Seattle, WA 98101 | |

Position(s) Held with the Trust: | Trustee | |

Term of Office: | Until successor is duly elected and qualified | |

Length of Time Served: | Trustee of RIC, RIF and RET Since 2014 | |

Number of Funds in the Fund Complex to be Overseen: | 47 | |

Principal Occupation(s) During the Past Five Years: | Retired Until February 2013, President Emerita, Laird Norton Wealth Management (investment company) April 2003 to December 2010, Chief Executive Officer of Laird Norton Wealth Management (investment company) | |

Other Directorships Held During the Past Five Years: | None. | |

Additional Information about the Trustee Nominees

The Trustees believe that each Trustee Nominee’s experience, qualifications, attributes and skills on an individual basis and in combination with those of the other Trustee Nominees and the Board, collectively, lead to the conclusion that the Trustee Nominees possess the requisite experience, qualifications, attributes and skills to serve on the Board. The Trustees believe that the Trustee Nominees’ ability to review critically, evaluate, question and discuss information provided to them; to interact effectively with RIMCo, other service providers, legal counsel and independent public accountants; and to exercise effective business judgment in the performance of their duties as Trustees, support this conclusion. The Trustees have also considered not only the contributions that each Trustee Nominee can make to the Board and the Trust based upon their particular background, business and professional experience, education and skills, among other things, but also whether such background, business and professional experience, education and skills enhance the Board’s diversity. The Board’s Nominating Committee believes that the Board generally benefits from diversity of background,

experience and views among its members, and considers this a factor in evaluating the composition of the Board, but has not adopted any specific policy on diversity or any particular definition of diversity.

As described in the table above, the Independent Trustee Nominees possess the experience and skills to provide them a basis of acquiring knowledge of the business and operation of the Funds and the Trusts. In addition, the following specific experience, qualifications, attributes and/or skills apply as to each Trustee nominee: Ms. Burgermeister has had experience as a member of the Board of Trustees of RIC, RIF and RET and as a certified public accountant and as a member of boards of directors/trustees of other investment companies; and Ms. Krysty also has experience as a member of the Board of Trustees of RIC, RIF and RET and has had business, financial and investment experience as the founder and senior executive of a registered investment adviser focusing on high net worth individuals as well as experience as a certified public accountant and a member of the boards of other corporations and non-profit organizations. Ms. Cavanaugh has had experience with RIC, RIF and RET and other financial services companies, including companies engaged in the sponsorship, management and distribution of investment companies. As a senior officer and/or director of the Funds, RIMCo and various affiliates of RIMCo providing services to the Funds, Ms. Cavanaugh is in a position to provide the Board with such parties’ perspectives on the management, operations and distribution of the Funds.

Why are Trustee Nominees Being Elected at the Present Time?

Section 16(a) of the Investment Company Act of 1940, as amended (the “1940 Act”), requires that a board of trustees may fill a board seat vacancy between meetings and without shareholder approval only if immediately after such vacancy is filled, at least two-thirds of the trustees then holding office were previously elected by shareholders. However, if, at any time, less than a majority of trustees have been elected by holders of the outstanding voting securities, the board of trustees would not be permitted to fill a board seat vacancy and would be required to call a special meeting within sixty (60) days for the purpose of electing trustees to fill any existing vacancies.

Following the (i) retirement of two shareholder-elected Trustees, effective December 31, 2013 and (ii) addition of a non-shareholder-elected Trustee effective, January 1, 2014, the RIC and RIF Boards are no longer composed of two-thirds shareholder-elected Trustees. Furthermore, because shareholder-elected Trustees would no longer constitute the majority of Trustees on the RIC and RIF Boards upon the resignation or removal of any existing Trustee in the future, each Trust would be required to hold a special meeting of the shareholders to elect a new Trustee. Such meeting would likely entail additional costs, including the costs of holding a special meeting and complying with the legal and regulatory costs associated with a shareholder vote. Accordingly, the Board recommends that Shareholders vote to provide the Board with the flexibility to fill a future vacancy without holding such a special meeting. If Proposal 1 is adopted, the Board of each Trust would be composed of greater than two-thirds shareholder-elected Trustees and, therefore, no Trust would be required to hold a special shareholder meeting to elect new Trustees.

Proposal 1 will not affect the status of those Trustees previously elected by RIC, RIF and RET Shareholders. Each of these Trustees will continue to hold office during the lifetime of the Trusts except as such Trustee sooner dies, retires, resigns or is removed, as provided for in the Trusts’ organizational documents. If any Trustee Nominee does not receive a plurality of all outstanding shares of the Trust voting, such Trustee Nominee will remain on the Board of such Trust as a non-shareholder elected Trustee. RIC and RIF also have one Trustee Emeritus. The Trustee Emeritus does not have the power to vote on matters coming before the Board, or to direct the vote of any Trustee, and generally is not responsible or accountable in any way for the performance of the Board’s responsibilities.

How Long Do Trustees Serve on the Board?

With respect to RIC and RIF, each Trustee shall serve during the continued lifetime of the Trust until he or she retires (or upon reaching the mandatory retirement age of 72), dies, resigns, or is removed by, in substance, a vote of two-thirds of the number of Trustees or of the Trust’s shares outstanding. With respect to RET, each

Trustee shall serve during the continued lifetime of the Trust until he or she retires (or upon reaching the mandatory retirement age of 72), dies, resigns, is declared bankrupt or incompetent by a court of competent jurisdiction, or is removed. With respect to all Trusts, any Trustee may resign at any time by written instrument signed by him and delivered to any officer of the Trust or to a meeting of the Trustees. Such resignation shall be effective upon receipt unless specified to be effective at some other time. Except to the extent expressly provided in a written agreement with a Trust, no Trustee resigning and no Trustee removed shall have any right to any compensation for any period following his or her resignation or removal, or any right to damages or other payment on account of such removal. Any Trustee may be removed at any time by a vote of at least two-thirds of the number of Trustees prior to such removal. Any Trustee may also be removed at any meeting of Shareholders by a vote of two thirds of the total

combined net asset value of all shares of the applicable Trust issued and outstanding. A meeting of Shareholders for the purpose of electing or removing one or more Trustees may be called (i) by the Trustees upon their own vote, or (ii) upon the demand of Shareholders of a Trust owning 10% or more of the shares of the Trust in the aggregate.

What are the Board’s Responsibilities?

The Board is responsible under applicable state law for generally overseeing management of the business and affairs of the Trusts and does not manage operations on a day-to-day basis. The officers of each Trust, all of whom are employed by and are officers of RIMCo or its affiliates, are responsible for the day-to-day management and administration of the Funds’ operations. The Board carries out its general oversight responsibilities in respect of the Funds’ operations by, among other things, meeting with the Trusts’ management at the Board’s regularly scheduled meetings and as otherwise needed and, with the assistance of the Trusts’ management, monitoring or evaluating the performance of the Funds’ service providers, including RIMCo, the Funds’ custodian and the Funds’ respective transfer agents. As part of this oversight process, the Board consults not only with management and RIMCo, but with the Trusts’ independent auditors, Fund counsel and separate counsel to the Independent Trustees. The Board monitors Fund performance as well as the quality of services provided to the Funds. As part of its monitoring efforts, the Board reviews Fund fees and expenses in light of the nature, scope and overall quality of services provided to the Funds. The Board is required under the 1940 Act to review and approve the Funds’ contracts with RIMCo and the money managers.

What are the Board’s Standing Committees?

Each Board has a standing Audit Committee that is composed of Mr. Jack R. Thompson and Mses. Kristianne Blake and Cheryl Burgermeister. Each Audit Committee operates under a formal written charter approved by its respective Board, which sets forth the Audit Committees’ current responsibilities. A copy of each charter is not available on the Trusts’ respective websites, but can be found attached to this Joint Proxy Statement under Exhibit A. The Audit Committee’s primary functions are: (1) to assist Board oversight of (a) the integrity of the Funds’ financial statements, (b) the Trusts’ compliance with legal and regulatory requirements that relate to financial reporting, as appropriate, (c) the independent registered public accounting firm’s qualifications and independence, and (d) the performance of the Trusts’ independent registered public accounting firm; (2) to oversee the preparation of an Audit Committee report as required by the SEC to be included in each Trust’s Form N-CSR or any proxy statement, as applicable; (3) to oversee the Trusts’ accounting and financial reporting policies and practices and its internal controls; and (4) to act as a liaison between the Trusts’ independent registered public accounting firm and the full Board. The Audit Committee reviews both the audit and non-audit work of the Trusts’ independent registered public accounting firm, submits a recommendation to the Board as to the selection of the independent registered public accounting firm, and pre-approves (i) all audit and non-audit services to be rendered by the independent registered public accounting firm for the Trusts, (ii) all audit services provided to RIMCo, or any affiliate thereof that provides ongoing services to the Trusts, relating to the operations and financial reporting of the Trusts, and (iii) all non-audit services relating to the operations and financial reporting of the Trusts, provided to RIMCo, or any affiliate thereof that provides ongoing services to the Trusts, by any auditors with an ongoing relationship with the Trusts. It is management’s responsibility to maintain appropriate systems for accounting and internal control and the auditor’s responsibility to plan and carry out a proper audit.

Each Board has a standing Nominating and Governance Committee that is composed of Messrs. Thaddas L. Alston and Raymond P. Tennison, Jr. and Ms. Kristianne Blake, all of whom are independent. Each Nominating and Governance Committee operates under a formal written charter approved by its respective Board, which sets forth the Nominating and Governance Committees’ current responsibilities. A copy of each charter is not available on the Trusts’ respective websites, but can be found attached to this Joint Proxy Statement under Exhibit C. The primary functions of the Nominating and Governance Committee are to: (1) nominate and evaluate individuals for Trustee membership on the Board, including individuals who are not interested persons of the Trusts for Independent Trustee membership; (2) supervise an annual assessment by the Trustees taking into account such factors as the Committee may deem appropriate; (3) review the composition of the Board; (4) review Independent Trustee compensation; and (5) make nominations for membership on all Board committees and review the responsibilities of each committee. In identifying and evaluating nominees, the Nominating and Governance Committee considers factors it deems relevant which include: whether or not the person is an “interested person” as defined in the 1940 Act and whether the person is otherwise qualified under applicable laws and regulations to serve on the Board;

whether or not the person has any relationship that might impair his or her independence, such as any business, financial or family relationships with Fund management, the investment adviser of the Funds, Fund service providers or their affiliates; whether or not the person serves on boards of, or is otherwise affiliated with, competing organizations or funds; and the character and integrity of the person and the contribution which the person can make to the Board. The Nominating and Governance Committee does not have a formal diversity policy but it may consider diversity of professional experience, education and skills when evaluating potential nominees. The Committee will not consider nominees recommended by Shareholders of the Funds.

Each Board also has a standing Investment Committee that is composed of Messrs. Thaddas L. Alston, Daniel P. Connealy and Raymond P. Tennison, Jr. and Mses. Katherine W. Krysty and Sandra Cavanaugh. Each Investment Committee operates under a written charter approved by its respective Board. The principal responsibilities of the Investment Committee are to: (1) regularly review and monitor the investment strategies and investment performance of the Funds; (2) review the kind, scope, and format of, and the time periods covered by, the investment performance data and related reports provided to the Board; (3) review the investment performance benchmarks and peer groups used in reports delivered to the Board; (4) review such matters that are related to the investments, investment strategies and investment performance of the Funds as would be considered by the Board as the Committee may deem to be necessary or appropriate; and (5) meet with any officer of the Trusts, or officer or other representative of RIMCo, any subadviser to a fund or other service provider to the Trusts.

How Does the Board of Trustees Oversee Risk?

The Board’s role in risk oversight of the Funds reflects its responsibility under applicable state law to oversee generally, rather than to manage, the operations of the Funds. In line with this oversight responsibility, the Board receives reports and makes inquiry at its regular meetings and as needed regarding the nature and extent of significant Fund risks (including investment, operational, compliance and valuation risks) that potentially could have a material adverse impact on the business operations, investment performance or reputation of the Funds, but relies upon the Funds’ management (including the Funds’ portfolio managers), the Funds’ Chief Compliance Officer (“CCO”), who reports directly to the Board, and RIMCo (including RIMCo’s Chief Risk Officer (“CRO”)) to assist it in identifying and understanding the nature and extent of such risks and determining whether, and to what extent, such risks may be eliminated or mitigated. Under the Funds’ multi-manager structure, RIMCo is responsible for oversight, including risk management oversight, of the services provided by the Funds’ money managers, and providing reports to the Board with respect to the money managers. In addition to reports and other information received from Fund management and RIMCo regarding the Funds’ investment program and activities, the Board as part of its risk oversight efforts meets at its regular meetings and as needed with representatives of the Funds’ senior management, including its CCO, to discuss, among other things, risk issues and issues regarding the policies, procedures and controls of the Funds. The Board receives quarterly reports from the CCO and other representatives of the Fund’s senior management which include information

regarding risk issues and receives an annual report from the CRO. The Board may be assisted in performing aspects of its role in risk oversight by the Audit Committee, the Investment Committee and such other standing or special committees as may be established from time to time by the Board. For example, the Audit Committee of the Board regularly meets with the Funds’ independent public accounting firm to review, among other things, reports on the Funds’ internal controls for financial reporting. The Board believes it is not possible to identify all risks that may affect the Funds; it is not practical or cost-effective to eliminate or mitigate all risks; and it is necessary for the Funds to bear certain risks (such as investment-related risks) to achieve their investment objectives. The processes or controls developed to address risks may be limited in their effectiveness and some risks may be beyond the reasonable control of the Board, the Funds, RIMCo, RIMCo’s affiliates or other service providers. Because the Chairman of the Board and the Chair of each of the Board’s Audit, Investment and Nominating and Governance Committees are Independent Trustees, the manner in which the Board administers its risk oversight efforts is not expected to have any significant impact on the Board’s leadership structure.

The Board has determined that its leadership structure, including its role in risk oversight, is appropriate given the characteristics and circumstances of the Funds, including such factors as the number of Funds, the Funds’ share classes, the Funds’ distribution arrangements and the Funds’ manager of managers structure. In addition, the Board believes that its leadership structure facilitates the independent and orderly exercise of its oversight responsibilities.

How Often Does the Board Meet?

The Board typically meets at least five times a year to review the operations of the Trusts and the Funds. During each Trust’sRIC’s last fiscal year, the Board met [7]8 times. During RIF’s last fiscal year, the Board met 7 times. During RET’s last fiscal year, the Board met 10 times. Generally, all meetings are held in person. The Audit Committee generally meets quarterly. During RIC’s last fiscal year, the Audit, Nominating and Governance and Investment Committees each met [4]4 times. During RIF’s last fiscal year, the Audit and Investment Committees each met 4 times and the Nominating and Governance Committee met [5]2 times. During RET’s last fiscal year, the Audit and Nominating and Governance and Investment Committees each met [4]4 times and the Investment Committee met 2 times.

Are the Trustees and Officers of the Trusts Paid for Their Services to the Trusts?

Trustees are paid an annual retainer plus meeting attendance and chairperson fees, both at the Board and Committee levels, in addition to any travel and other expenses incurred in attending Board and Committee meetings. The Trusts’ officers and employees are paid by RIMCo or its affiliates.

The following table sets forth the compensation that was paid to each Trustee by the Trusts for the calendar year ending December 31, 2013. [TO BE COMPLETED UPON AMENDMENT]

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

Name of Trustee | Aggregate Compensation From RIC | Aggregate Compensation From RIF | Aggregate Compensation from RET | Pension or Retirement Benefits Accrued as Part of Trust’s Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from Fund Complex | ||||||||||||||||||

Interested Trustees |

| |||||||||||||||||||||||

Sandra Cavanaugh | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

Daniel P. Connealy | $ | 119,744 | $ | 7,434 | $ | 20 | $ | 0 | $ | 0 | $ | 127,198 | ||||||||||||

Independent Trustees | ||||||||||||||||||||||||

Thaddas L. Alston | $ | 147,414 | $ | 9,161 | $ | 25 | $ | 0 | $ | 0 | $ | 156,600 | ||||||||||||

Kristianne Blake | $ | 212,082 | $ | 13,184 | $ | 35 | $ | 0 | $ | 0 | $ | 225,301 | ||||||||||||

Cheryl Burgermeister | $ | 136,933 | $ | 8,507 | $ | 23 | $ | 0 | $ | 0 | $ | 145,463 | ||||||||||||

Katherine W. Krysty(1) | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

Raymond P. Tennison, Jr. | $ | 152,432 | $ | 9,468 | $ | 25 | $ | 0 | $ | 0 | $ | 161,925 | ||||||||||||

Jack R. Thompson | $ | 153,987 | $ | 9,573 | $ | 26 | $ | 0 | $ | 0 | $ | 163,586 | ||||||||||||

Trustee Emeritus | ||||||||||||||||||||||||

George F. Russell, Jr. | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||

| (1) | Ms. Krysty was elected to the Board of Trustees effective January 1, 2014. |

Do the Trustee Nominees Own Fund Shares?

As of December 31, 2013, the Trustee Nominees owned the following with respect to all funds in the Russell family of investment companies: [TO BE COMPLETED UPON AMENDMENT]

Trustee Nominee | Dollar Range of Equity Securities owned in each Fund | Aggregate Dollar Range of Equity Securities To Be Overseen by Nominee in Family of Investment Companies | ||||||

Sandra Cavanaugh | $1-$10,000 | |||||||

| Russell U.S. Dynamic Equity Fund | $1-$10,000 | |||||||

| Russell U.S. Small Cap Equity Fund | $1-$10,000 | |||||||

| Russell Global Equity Fund | $1-$10,000 | |||||||

| Russell Emerging Markets Fund | $1-$10,000 | |||||||

| Russell Global Infrastructure Fund | $1-$10,000 | |||||||

| Russell Global Real Estate Securities Fund | $1-$10,000 | |||||||

| Russell Short Duration Bond Fund | $1-$10,000 | |||||||

| Russell Multi-Strategy Alternative Fund | $1-$10,000 | |||||||

Cheryl Burgermeister | ||||||||

Katherine W. |

| * | Ms. Krysty was elected to the Board of Trustees effective January 1, 2014. |

How Should I Vote on the Proposal?

The Trusts’ Board of Trustees unanimously recommends that you vote “FOR ALL” of the Trustee Nominees for RIC and RIF and “FOR” the Trustee Nominee for RET.

PROPOSAL 2: APPROVAL OF RECLASSIFICATION OF THE INVESTMENT OBJECTIVES OF

CERTAIN FUNDS FROM “FUNDAMENTAL” TO “NON-FUNDAMENTAL”

For purposes of Proposal 2, references to the words “Fund” or “Funds” apply only to the following RIC Funds:

Russell U.S. Defensive Equity Fund, Russell Investment Grade Bond Fund and Russell International Developed

Markets Fund.

Information About the Proposed Reclassifications

As described in the following proposal, the Board also recommends that the shareholders of the Funds approve the reclassification of the investment objective of each of the Funds from “fundamental” to “non-fundamental.” A fund is required under the Investment Company Act of 1940 (the “1940 Act”) to disclose its investment objective in its registration statement. The investment objective is the overall goal of a fund, and determines the fund’s overall principal investment strategies, including particular types of securities in which the fund principally invests or will invest. The 1940 Act does not require shareholder approval to change a fund’s investment objective, unless the fund has designated the investment objective as an investment policy that may be changed only with shareholder approval. The investment objective for each Fund is a “fundamental” investment policy, meaning that it may not be changed without Shareholder approval. Because the Funds’ investment objectives are not required to be fundamental, RIMCo has proposed to the Board that the investment objective for each Fund be reclassified from “fundamental” to “non-fundamental.”

If the Shareholders of a Fund approve the Proposed Reclassification, the Board thereafter would be permitted to change the investment objective for such Fund, if the Board deems the change to be in the best interests of Shareholders. However, if these Funds’ investment objectives remain fundamental and the Board determined that it was in the best interests of Shareholders to change an investment objective, each such Fund would be required to hold a Shareholder meeting at which such change would be voted upon, and to prepare and send a proxy statement to Shareholders seeking their instructions as to how to vote shares at such meeting. Obtaining ShareholderIn obtaining shareholder approval, to changecertain costs (including the Funds’ investment objectives is likely to involve significantcosts of preparing and mailing a proxy statement and conducting a special shareholder meeting) will be incurred and there may be delays and costs.in obtaining the approval. The Proposed Reclassifications would provide additional flexibility to conduct the investment program of each Fund in response to changing market conditions and circumstances consistent with applicable laws. RIMCo believes that the Proposed Reclassifications will assist the Funds to avoid the expense and delay associated with arranging for such a Shareholder meeting when the desire or need arises in the future. If approved, the Proposed Reclassifications would continue to satisfy current regulatory requirements.

As the Board, through its Investment Committee, reviews and monitors the investment strategies and investment performance of all RIC, RIF and RET Funds, including the Proposal 2 Funds, the Trustees would be in a position to change the investment objective of any such Fund in circumstances when a change, in the Board’s judgment, would

be in the best interests of the Fund’s shareholders. The Board may determine to change the investment objective of a Fund if, for instance, based on developments in the securities markets, the Board believes that a modified investment objective would better serve Shareholders’ interests. Such a determination could result from changes in the securities markets generally or from changes with respect to a Fund specifically. If the Board did decide to make such a change in any non-fundamental investment objective, the Fund would provide Shareholders with reasonable notice before the effective date of such change. If Proposal 2 is approved, the current investment objectives of the Funds would not change. It is expected that each Fund will continue to be managed in accordance with its current prospectus and statement of additional information (other than the reclassification of each Fund’s investment objective from fundamental to non-fundamental), as well as any policies or guidelines that may have been established by the Board or RIMCo. Accordingly, RIMCo does not anticipate that the changes will result in a material change in the level of investment risk associated with investment in any Fund or the manner in which any Fund is managed at the present time.

If Shareholders do not approve a Proposed Reclassification with respect to one or more Proposal 2 Funds, each such Proposal 2 Fund’s investment objective would remain “fundamental.” Accordingly, if, at a future date, the

Board determined that it was in the best interests of Shareholders to change such Proposal 2 Fund’s investment objective, the Proposal 2 Fund would be required to (i) hold a Shareholder meeting at which such change would be voted upon, and (ii) prepare and send a proxy statement to Shareholders seeking their instructions as to how to vote shares at such meeting. Obtaining ShareholderIn obtaining shareholder approval, to changecertain costs (including the costs of preparing and mailing a Proposal 2 Fund’s investment objective is likely to involve significantproxy statement and conducting a special shareholder meeting) will be incurred and there may be delays and costs.in obtaining the approval.

What are the Effects of Reclassifying Each Investment Objective?

The table below summarizes the effects of reclassifying each investment objective from fundamental to non-fundamental:

Fundamental Investment Objective (Current Approach) | Non-Fundamental Investment Objective

| |||

Who must approve changes in a fundamental investment objective? | Board and Shareholders | Board | ||

How quickly can a change to the investment objective be made? | Relatively slowly, since a vote of Shareholders is required. | Relatively quickly, because the change can be accomplished by action of the Board alone; provided that Shareholders are provided reasonable notice that their Fund’s objective is being changed. | ||

What is the relative cost to change an investment objective? | Costly to change because a Shareholder vote requires holding a meeting of Shareholders with additional SEC filing requirements and proxy solicitation efforts. | Less costly to change because a change can be accomplished by action of the Board without Shareholder approval. | ||

Shareholders of each Fund are not being asked to approve a change of the Fund’s investment objective. Accordingly, the investment objective of each Fund currently in effect would not change at the Special Meeting if Shareholders vote to approve Proposal 2 with respect to any or all Funds.

The Funds’ Current Fundamental Investment Objectives

The current fundamental investment objective for each Fund is as follows:

Fund Name | Current Investment Objective | |

Russell U.S. Defensive Equity Fund | The Fund seeks to provide long term capital growth. | |

Russell Investment Grade Bond Fund | The Fund seeks to provide current income and the preservation of capital. | |

Russell International Developed Markets Fund | The Fund seeks to provide long term capital growth. | |

How Should I Vote on the Proposal?

The Board unanimously recommends that you vote “FOR” the adoption of the Proposed Reclassifications.

Current Trustees of the Trusts

Unless otherwise noted, the principal business address of each Trustee and executive officer of the Trust is 1301 Second Avenue, 18th Floor, Seattle, Washington 98101.

Name, Address, and

| Position(s) Held with

| Term of Office* | Principal Occupation(s) During Past 5 Years | Number

| Other

| |||||

Interested Trustees | ||||||||||

Sandra Cavanaugh# Born May 10, 1954 1301 Second Avenue, 18th Floor, Seattle, WA 98101 | President and Chief Executive Officer of (RIC and RIF since 2010) (RET since 2012)

Trustee (RIC and RIF since 2010) (RET since 2012) | Until successor is chosen and qualified by Trustees

Appointed until successor is duly elected and qualified | President and CEO, RIC, RIF and RET; Chairman of the Board, Co-President and CEO, Russell Financial Services, Inc. (“RFS”); Chairman of the Board, President and CEO, Russell Fund Services Company (“RFSC”); Director, RIMCo; Chairman of the Board, President and CEO, Russell Insurance Agency, Inc. (“RIA”) (insurance agency); May 2009 to December 2009, Executive Vice President, Retail Channel, SunTrust Bank; 2007 to January 2009, Senior Vice President, National Sales – Retail Distribution, JPMorgan Chase/Washington Mutual, Inc. (investment company) | 47 | None | |||||

Daniel P. Connealy## Born June 6, 1946 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee (RIC and RIF since 2003) (RET since 2012) | Appointed until successor is duly elected and qualified | June 2004 to present, Senior Vice President and Chief Financial Officer, Waddell & Reed Financial, Inc. (investment company) | 47 | None | |||||

| * | Each Trustee is subject to mandatory retirement at age 72. |

| # | Ms. Cavanaugh is also an officer and/or director of one or more affiliates of RIC, RIF and RET and is therefore classified as an Interested Trustee. |

| ## | Mr. Connealy is an officer of a broker-dealer that distributes shares of the RIC Funds and is therefore classified as an Interested Trustee. |

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office* | Principal Occupation(s)

| Number of Portfolios

Complex

By Trustee* | Other Directorships held by Trustee | |||||

| Independent Trustees | ||||||||||

Thaddas L. Alston Born April 7, 1945 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee (RIC and RIF since 2006)(RET since 2012)

Chairman of the Investment Committee (RIC and RIF since 2010)(RET since 2012) | Appointed until successor is chosen and qualified by Trustees

Appointed until successor is duly elected and qualified | Senior Vice President, Larco Investments, Ltd. (real estate firm) | 47 | None | |||||

Kristianne Blake Born January 22, 1954 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee (RIC and RIF since 2000)(RET since 2012)

Chairman (RIC and RIF since 2005)(RET since 2012) | Appointed until successor is duly elected and qualified

Annual | Director and Chairman of the Audit Committee, Avista Corp. (electric utilities); Regent, University of Washington; President, Kristianne Gates Blake, P.S. (accounting services); Until December 31, 2013, Trustee and Chairman of the Operations Committee, Principal Investor Funds and Principal Variable Contracts Funds (investment company) | 47 | Director, Avista Corp (electric utilities); Until December 31, 2013, Trustee, Principal Investor Funds (investment company); Until December 31, 2013, Trustee, Principal Variable Contracts Funds (investment company) | |||||

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office* | Principal Occupation(s) During Past 5 Years | Number By Trustee* | Other Directorships held by Trustee | |||||

Cheryl Burgermeister Born June 26, 1951 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee since 2012 | Appointed until successor is duly elected and qualified | Retired; Trustee and Chairperson of Audit Committee, Select Sector SPDR Funds (investment company); Trustee and Finance Committee Member/Chairman, Portland Community College (charitable organization) | 47 | Trustee and Chairperson of Audit Committee, Select Sector SPDR Funds (investment company); Trustee, ALPS Series Trust (investment company) |

Katherine W. Krysty Born December 3, 1951 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee since 2014 | Appointed until successor is duly elected and qualified | Retired; January 2011 through February 2013, President Emerita of Laird Norton Wealth Management (investment company); April 2003 through December 2010, Chief Executive Officer of Laird Norton Wealth Management (investment company) | 47 | None | ||||||||||

Raymond P. Tennison, Jr. Born December 21, 1955 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee (RIC and RIF since 2010)(RET since 2012)

Chairman of Nominating and Governance Committee (RIC and RIF since 2010)(RET since 2012) | Appointed until successor is duly elected and qualified

Appointed until successor is duly elected and qualified | Vice Chairman of the Board, Simpson Investment Company (paper and forest products); Until November 2010, President, Simpson Investment Company and several additional subsidiary companies, including Simpson Timber Company, Simpson Paper Company and Simpson Tacoma Kraft Company | 47 | None | ||||||||||

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office* | Principal Occupation(s) During Past 5 Years | Number By Trustee* | Other Directorships held by Trustee | |||||

Jack R. Thompson Born March 21, 1949 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee (RIC and RIF since 2005)(RET since 2012)

Chairman of Audit Committee since 2012 | Appointed until successor is duly elected and qualified

Appointed until successor is duly elected and qualified | September 2007 to September 2010, Director, Board Chairman and Chairman of the Audit Committee, LifeVantage Corporation (health products company); September 2003 to September 2009, Independent Board Chair and Chairman of the Audit Committee, Sparx Asia Funds (investment company) | 47 | Director, Board Chairman and Chairman of the Audit Committee, LifeVantage Corporation until September 2010 (health products company); Director, Sparx Asia Funds until 2009 (investment company) |

| * | Each Trustee is subject to mandatory retirement at age 72. |

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office* | Principal Occupation(s)

| Number of Portfolios in Fund Complex

By

| Other Directorships held by Trustee | |||||

| Trustee Emeritus | ||||||||||

George F. Russell, Jr. Born July 3, 1932 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Trustee Emeritus and Chairman Emeritus (RIC and RIF since 1999) | Until resignation or removal | Director Emeritus, Frank Russell Company (investment consultant to institutional investors (“FRC”)) and RIMCo; Chairman Emeritus, RIC and RIF, Russell Implementation Services Inc. (broker-dealer and investment adviser (“RIS”)), Russell 20-20 Association (non-profit corporation), and Russell Trust Company (non-depository trust company (“RTC”)); Chairman, Sunshine Management Services, LLC (investment adviser) | 47 | None |

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office | Principal Occupation(s) During Past 5 Years | |||

Cheryl Wichers Born December 16, 1966 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Chief Compliance Officer (RIC and RIF since 2005)(RET since 2011) | Until removed by Independent Trustees | Chief Compliance Officer, RIC, RIF and RET; Chief Compliance Officer, RFSC 2005 – Present; Chief Compliance Officer, RIMCo, 2005 – 2011; Chief Compliance Officer, U.S. One Inc. | |||

Sandra Cavanaugh Born May 10, 1954 1301 Second Avenue, 18th Floor Seattle, WA 98101 | President and Chief Executive Officer (RIC and RIF since 2010)(RET since 2012) | Until successor is chosen and qualified by Trustees | CEO, U.S. Private Client Services, Russell Investments; President and CEO, RIC, RIF and RET; Chairman of the Board, Co-President and CEO, RFS; Chairman of the Board, President and CEO, RFSC; Director, RIMCo; Chairman of the Board, President and CEO, RIA; May 2009 to December 2009, Executive Vice President, Retail Channel, SunTrust Bank; 2007 to January 2009, Senior Vice President, National Sales – Retail Distribution, JPMorgan Chase/Washington Mutual, Inc. | |||

Mark E. Swanson Born November 26, 1963 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Treasurer and Chief Accounting Officer (RIC and RIF since 1998)(RET since 2011) | Until successor is chosen and qualified by Trustees | Treasurer, Chief Accounting Officer and CFO, RIC, RIF and RET; Director, RIMCo, RFSC, RTC and RFS; Global Head of Fund Services, Russell Investments; October 2011 to December 2013, Head of North America Operations, Russell Investments; May 2009 to October 2011, Global Head of Fund Operations, Russell Investments; 1999 to May 2009, Director, Fund Administration | ||||||

Name, Address, and Date of Birth | Position(s) Held with the Fund | Term of Office | Principal Occupation(s) During Past 5 Years | |||

Jeffrey T. Hussey Born May 2, 1969 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Chief Investment Officer since 2013 | Until removed by Trustees | Global Chief Investment Officer, Russell Investments; Chief Investment Officer, RIC, RIF and RET; Chairman of the Board, President and CEO, RIMCo; 2008 to 2013 Chief Investment Officer, Fixed Income, Russell Investments | |||

Mary Beth Rhoden Albaneze Born April 25, 1969 1301 Second Avenue, 18th Floor Seattle, WA 98101 | Secretary (RIC and RIF since 2010)(RET since 2011) | Until successor is chosen and qualified by Trustees | Associate General Counsel, Russell Investments; Secretary, RIMCo, RFSC and RFS; Secretary and Chief Legal Officer, RIC, RIF and RET; Assistant Secretary, RFS, RIA and U.S. One Inc.; 1999 to 2010 Assistant Secretary, RIC and RIF | |||

Most of the Trusts’ necessary day-to-day operations are performed by separate business organizations under contract to the Trusts. The principal service providers are:

| Investment Advisory Services | ||

• Investment Adviser (RIC & RIF) • Investment Manager (RET) | Russell Investment Management Company (“RIMCo”) | |